Executive summary

Amid the rising damage and escalating costs associated with climate change, U.S. leaders increasingly recognize the need for a comprehensive national response. It will take trillions of dollars, both public and private, to modernize the nation’s electric grid, construct new manufacturing facilities, and retrofit enough buildings to dramatically reduce the country’s carbon footprint and protect people and physical assets from an increasingly unstable climate.1

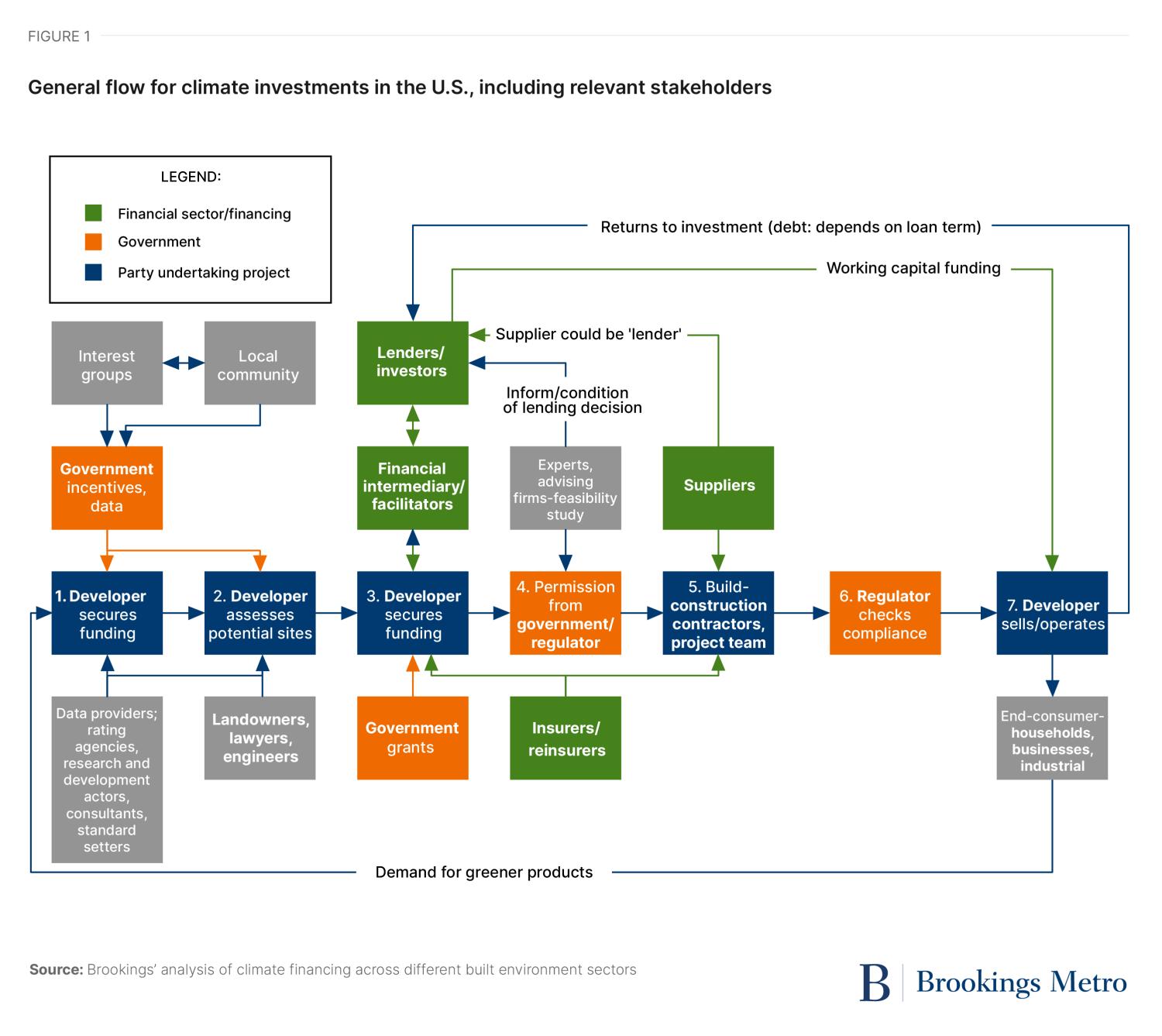

While the federal government and many state and local governments are launching historic climate investments, they cannot meet these challenges alone. The private sector has an immense role to play. Banks, investment funds, insurers, and other financial institutions are adept at moving large amounts of capital, with speed, to almost every corner of the country. Financial institutions serve as the matchmakers between savers and investors seeking returns on their capital and project developers who require upfront funding. Put differently, financial markets help convert the country’s climate intentions into climate action.

But even if they can move money quickly, financial markets are not nearly as adept at advancing broader social objectives. The most profitable projects often do not align with the most urgent climate challenges or social needs, leading to over-development of some kinds of projects, under-development of others, and exposure to heightened economic and financial risk.2 Climate risks are especially pronounced for the most vulnerable people, businesses, and places, many of whom already face relatively large climate impacts like extreme heat and costly disasters, as well as localized pollution from emissions-intensive activities.

Despite the bold pledges and commitments by many government actors and businesses, the specific policies and processes by which U.S. investors choose and execute on projects are, in many respects, out of sync with climate equity: the goal of ensuring that all peoples—irrespective of their identity, location, or background—are not adversely impacted by climate change and that they have equal opportunity to benefit from climate policies.3 If stakeholders want to meet those pledges and commitments, they need a sober assessment of what is limiting both aggregate and targeted investment in vital climate action.

This report examines the barriers to financing projects that could deliver more equitable climate outcomes across five key sectors: buildings, transportation, energy, industry, and agriculture. Each of these sectors is a major contributor to national greenhouse gas (GHG) emissions and each is experiencing the impacts of a changing climate in significant and costly ways. In other words, each of these massive, capital-intensive sectors is pivotal for progress on climate mitigation and adaptation. More detailed context is available in sector-specific briefs linked to below.

Across all these sectors, a consistent theme emerged through the in-depth interviews with over 30 experts and the extensive literature review we conducted: public policy has not done enough to incentivize climate investments at the scale needed to address long-term environmental and social costs.

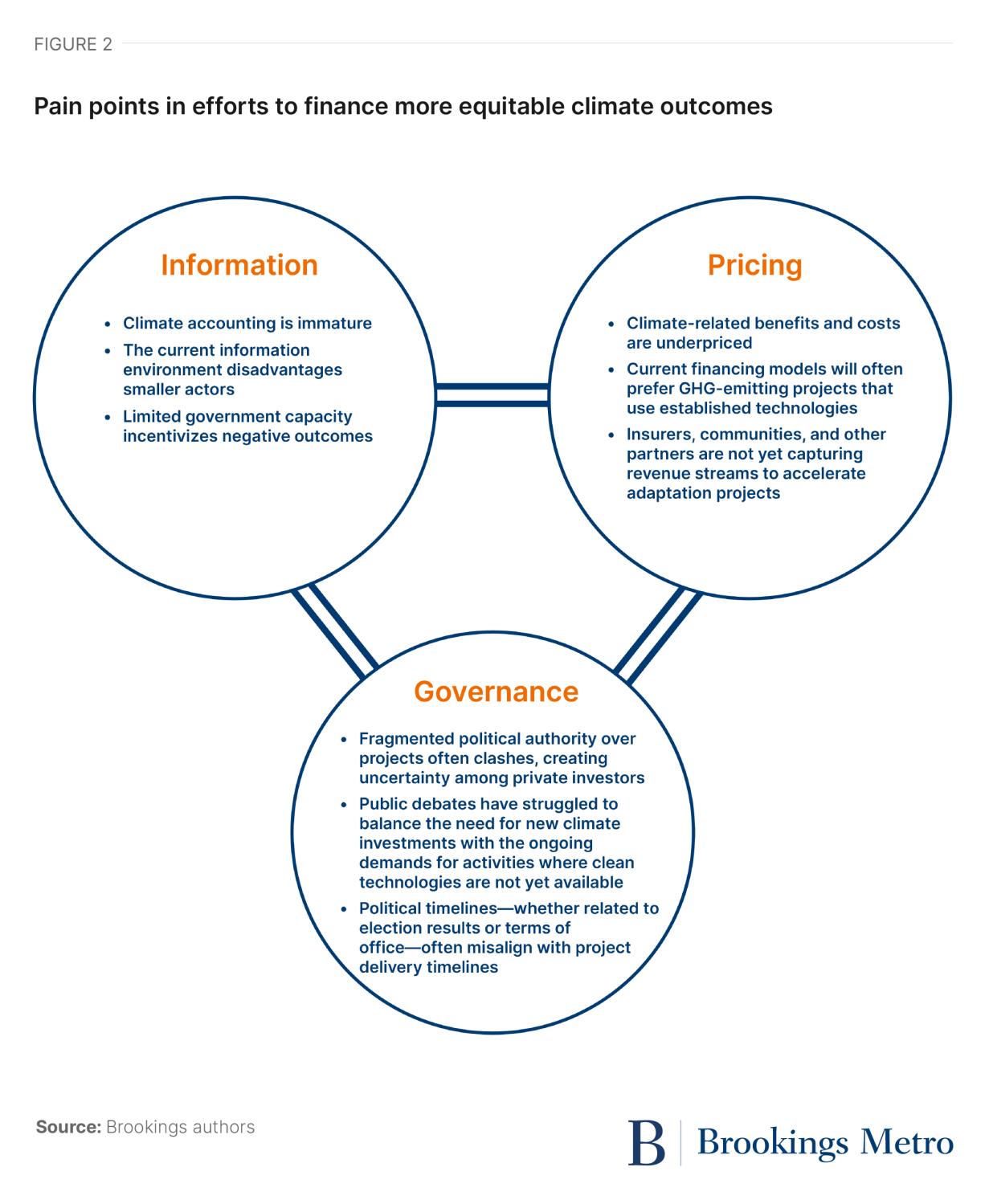

Unleashing private capital to scale up and speed up project delivery, then, requires addressing underlying market and policy failures to better align with and respond to climate risks. This report identifies nine pain points that limit more equitable climate investment, organized into three main categories: information, pricing, and governance. While each of these pain points matters in and of itself, the complex interplay between them also explains why private investors are not yet delivering all that they can. The full report includes examples related to each pain point.

Read the full report

Information pain points

Pain Point 1: Climate accounting is immature.

Many in the financial sector recognize the need for improved accounting methods for tracking companies’ and government actors’ total emissions and physical risk exposures. Yet even with greater attention, the lack of consensus about how to quantify climate benefits and costs makes it more difficult to fundraise for mitigation- and resilience-focused projects, particularly for climate-related social projects where traditional financial accounting would underestimate their benefits. Conversely, a lack of climate accounting standards also creates openings for greenwashing, a practice where asset owners and investors overstate the climate-related benefits of their projects or financial assets.

Pain Point 2: The current information environment poses disadvantages to small actors.

Climate analytics is a growing field, with rapid improvements and the near-constant introduction of new products to track environmental risk, emissions, sustainable investment opportunities, and more.4 Yet there are real barriers to acquiring and using this data among public and private actors alike, including financial cost, data management proficiency, and the expertise needed to understand each product’s advantages and disadvantages. That sort of information environment inherently favors larger companies, investors, public agencies, and research institutions that can commit the human and financial resources required to use climate data effectively.

Pain Point 3: Limited government capacity incentivizes negative outcomes.

Local, state, and federal government staff are involved in all the major economic sectors that need to physically transform to address climate change. Yet after decades of underfunding, especially when it comes to human capital, many public agencies are not prepared to effectively manage more climate-focused projects, let alone equipped to embed climate equity considerations into their financing, construction, or long-term maintenance and operational plans. Instead, limited staff knowledge can make it easier for maladaptive projects to advance, creating the potential for negative externalities for vulnerable groups or regions.

Pricing pain points

Pain Point 4: Climate-related benefits and costs are underpriced, and in some cases they are unpriced, particularly due to a lack of established cost-of-carbon metrics or similar measures.

Economists, regulators, and some business leaders have long argued to use better pricing, supported by smart and fair pricing policies, to address such market failures.5 Yet even with past successes like the Acid Rain Program and tax credits for renewable energy generation projects, pricing policies are not yet comprehensive. Stopgap solutions like first-loss capital and other impact investing techniques do support some projects, but they are dependent on the highly specific preferences of particular asset owners and their willingness to run reputational and other risks, as recent public debates around environmental, social, and governance policies have underscored.6

Pain Point 5: Current financing models often favor GHG-emitting projects that use established technologies.

Since capital projects often are in operation for decades—and have high upfront construction costs—lenders want deals that give them a high degree of confidence that these projects will work as intended and that the developers can comfortably repay their debt over long time periods. That kind of financing environment inherently favors projects using well-established technologies and asset owners with well-established credit, even if the proposed projects also generate higher emissions than alternative proposals. The term most frequently used among insiders is bankability: emissions-saving projects typically do not have an expected profitability advantage over more polluting projects.

Pain Point 6: Insurers, communities, and other partners are not yet capturing revenue streams to accelerate adaptation projects.

The core issue is a lack of revenue, or agreed-upon cost savings (revenue by another name), associated with adaptation projects.7 While such projects aim to reduce future damage by improving environmental resilience, avoiding future damage is not the same as creating new, present-day revenue—and investors need long-term revenue streams to finance projects.8 Instead, governments and insurers tend to wait until damage occurs and then fund rebuilding efforts. The result is that such proceeds disproportionally flow to the wealthiest households and businesses (since they experience the greatest on-paper losses), the long-term repayment burden is dispersed across society, and many low-income communities are still left most at risk.9

Governance pain points

Pain Point 7: Fragmented political authority over projects often clashes, creating uncertainty among private investors.

With the need to reduce emissions everywhere, the patchwork policies that have emerged make it harder to deploy private financing in the locations that need it the most. Regulating emissions is one area of legal contention between different levels of government, as is seen from California’s long-standing authority to set air quality standards that exceed those in the federal Clean Air Act. Real estate markets suffer from a different set of regulatory and policy complexities, with each level of government having distinct yet interacting responsibilities, all of which create friction in the pursuit of decarbonization and adaptation.

For more information, see page 36 in the full report »

Pain Point 8: Public debates have struggled to balance the need for new climate investments with the ongoing demands to finance established economic activities where clean technologies are not yet available.

America’s climate debates are overly reductive, missing critical nuances in the phasing and location of climate-related project financing.10 For example, even if the entire country agreed on an aggressive vehicle and home electrification strategy, the economy still would need investment in the oil and gas industry for use in sectors as they transition, plus some uses that may never transition.11 Where such fossil fuel–related industrial transitions will occur, it is especially important to consider how to support career transitions for the workers and households who depend on these industries.

Pain Point 9: Political timelines—whether related to election results or terms of office—often misalign with project delivery timelines.

Officials win elections by promising to solve problems, and they stay in office—or earn higher offices—when they have a clear record of achievement. Yet many climate-related projects take years to show results, so it is little wonder that elected officials are far more likely to deliver climate pledges than to commit serious public dollars to building or financing such projects.12 Policy reversals are an even more egregious example of political misalignment, as evidenced by recent presidential administrations flip-flopping on global climate agreements. Such political volatility introduces market volatility, forcing investors to question whether they should adhere to today’s policy environment or imagine future scenarios.

Conclusion

Climate change is a truly wicked problem. When trying to capture the scale of the challenge, it is not enough to point out that it will cost trillions of dollars to retrofit entire economic sectors or that the dollars needed for such investments should be mobilized within a relatively tight time frame to avoid or manage climate change’s most dramatic impacts. These efforts are made far more difficult by the fact that climate change is not just one problem to solve and that there is no one set of public policies or market failures to address. Instead, an amalgamation of factors—including the nine pain points presented here—vary significantly depending on the economic sector being assessed and the community confronting risks.

Still, there are reasons for optimism: the general public recognizes the threats that climate change poses, many private investors continue to bet on climate-focused projects, and governments continue to implement climate action strategies. If public and private leaders want to mobilize even more private capital for public good, it is imperative to address these pain points head on.

Read the full report

Equitable climate finance series

-

Acknowledgements and disclosures

This research series was made possible by an incredible group of colleagues within and outside the Brookings Institution. The authors would especially like to thank Samantha Gross, Alan Berube, and the over 30 external experts who provided guidance and input throughout the project. The authors also would like to thank Carie Muscatello for her web and print design and the rest of the Brookings Metro communications team for their support.

Funding for this research was provided by HSBC Bank USA, N.A. The program is also grateful to the Metropolitan Council, a network of business, civic, and philanthropic leaders that provides both financial and intellectual support to the program. The views expressed in this report are solely those of its authors and do not represent the views of the donors, their officers, or employees.

-

Footnotes

- See Appendix B for more details. While estimates vary, several reports point to multi-trillion dollar estimates over time. For instance, see McKinsey Global Institute, The Net-Zero Transition: What It Would Cost, What It Could Bring (New York: McKinsey and Company, January 2022), https://www.mckinsey.com/~/media/mckinsey/business%20functions/sustainability/our%20insights/the%20net%20zero%20transition%20what%20it%20would%20cost%20what%20it%20could%20bring/the-net-zero-transition-what-it-would-cost-and-what-it-could-bring-final.pdf.

- U.S. Federal Reserve Board, “Federal Reserve Board Releases Summary of the Exploratory Pilot Climate Scenario Analysis (CSA) Exercise That It Conducted With Six of the Nation’s Largest Banks,” May 9, 2024, https://www.federalreserve.gov/newsevents/pressreleases/other20240509a.htm.

- Based on Brookings’ interview findings.

- Jenny Schuetz, Adie Tomer, Caroline George, Joseph W. Kane, and Julia Gill, “Local Climate Risk Data Could Enable Better Decisionmaking by Households and Policymakers,” Brookings Institution, February 8, 2023, https://www.brookings.edu/articles/local-climate-risk-data-could-enable-better-decisionmaking-by-households-and-policymakers.

- Richard Cornes and Todd Sandler, The Theory of Externalities: Public Goods and Club Goods (New York: Cambridge University Press, 1996) https://books.google.com/books?hl=en&lr=&id=sN1ktBy2F14C&oi=fnd&pg=PA9&dq=The+Theory+of+Externalities,+Public+Goods,+and+Club+Goods&ots=kWuHBkpQ4&sig=DYdZsAHWEBE_eQkPeCtH4qMFyo0#v=onepage&q=The%20Theory%20of%20Externalities%2C%20Public%20Goods%2C%20and%20Club%20Goods&f=false; and Jonathan L. Ramseur and Jane A. Leggett, “Attaching a Price to Greenhouse Gas Emissions With a Carbon Tax or Emissions Fee: Considerations and Potential Impacts” Congressional Research Service, March 22, 2019, https://crsreports.congress.gov/product/pdf/R/R45625.

- James Surowiecki. “The War on ‘Woke Capital’ Is Backfiring,” The Atlantic, January 31, 2024, https://www.theatlantic.com/ideas/archive/2024/01/republicans-woke-capital-esg-investment/677294

- Based on Brookings’ interview findings.

- Veronica Chau et al., “From Risk to Reward: The Business Imperative to Finance Climate Adaptation and Resilience,” BCG, the Global Resilience Partnership, and the U.S. Agency for International Development, December 2023, https://web-assets.bcg.com/8b/0b/8246ed074a76971cde923bddb994/bcg-from-risk-to-reward-dec-2023.pdf.

- Various authors, “Reforming National Disaster Policy,” Brookings Institution, https://www.brookings.edu/collection/reforming-national-disaster-policy; and Matt Levin, “Home Insurance Premiums Are Surging. That’s Bad for Low-Income Housing—and Its Residents.,” Marketplace, July 3, 2024, https://www.marketplace.org/2024/07/03/home-insurance-premiums-are-surging-thats-bad-news-for-low-income-housing-and-its-residents.

- Mikael Karlsson, Eva Alfredsson, and Nils Westling, “Climate Policy Co-Benefits: A Review,” Climate Policy 20, no. 3 (2020): 292–316, https://www.tandfonline.com/doi/full/10.1080/14693062.2020.1724070.

- Dmitry Marinchenko, Angelina Valavina, Jakub Zasada, and Guillaume Dagerre,. “Oil and Gas and Chemicals: Long-Term Climate Vulnerability Signals Update,” Fitch Ratings, September 2, 2023, https://www.fitchratings.com/research/corporate-finance/oil-gas-chemicals-long-term-climate-vulnerability-scores-update-09-02-2023 .

- Joseph Kane, Adie Tomer, Caroline George, and Jamal Russell Black, “Not According to Plan: Exploring Gaps in City Climate Planning and the Need for Regional Action,” Brookings Institution, September 2022, https://www.brookings.edu/wp-content/uploads/2022/09/Decarbonization_final.pdf.